-

The Petrodollar’s Original Sin

How the U.S. forced oil trades in dollars (1971-2023);

1. The 1970s: Birth of the Petrodollar

-

1971: Nixon ended the Bretton Woods system, decoupling the dollar from gold.

-

1973-74: The U.S. struck a secret deal with Saudi Arabia (via the U.S.-Saudi Arabian Joint Commission) ensuring that oil would be priced and traded exclusively in USD.

-

In exchange, the U.S. offered military protection and investments in Saudi infrastructure.

-

Other OPEC nations followed, making the dollar the global oil currency.

-

2. Enforcement: Sanctions & Wars

The U.S. has used economic and military power to maintain dollar dominance:

-

Iraq (2000): Saddam Hussein switched oil sales to euros; the U.S. invaded in 2003.

Image 1: An American Obsession -

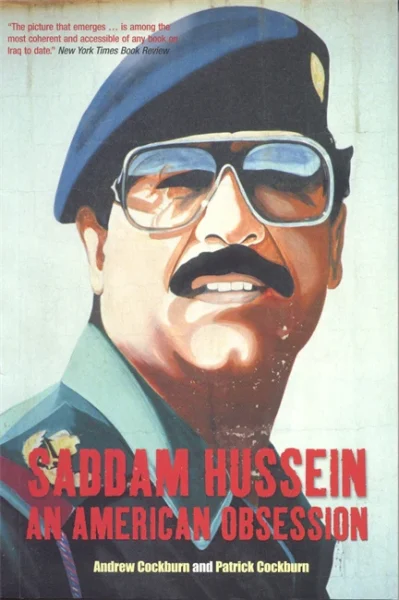

Libya (2011): Gaddafi planned a gold-backed African dinar for oil; NATO intervened.

Image 2: The US Helped Murder Gaddafi to Stop the Creation of Gold -Backed Currency | by Evangelos -

Venezuela & Iran: Both tried selling oil in non-dollar currencies (euros, yuan, crypto) and faced severe sanctions.

Image 3: Venezuela and Iran hold the largest and third-largest petroleum reserves in the world, respectively. Both have also been targeted for regime change by Washington

3. Recent Challenges (2020s)

-

Russia & China: Now trading oil in yuan, rubles, and local currencies.

Image 5: Russia dropping US dollar for Chinese yuan -

BRICS Nations: Pushing for de-dollarization in oil trade.

Image 6: BRICS+ nations determined to trade in their own currencies – Asia Times -

It was never about trade—it was about control;

1. The Real Motive: Locking the World into Dollar Dependency

-

Oil is the lifeblood of industrial economies. By forcing oil to be traded in dollars, the U.S. ensured that every country needed massive dollar reserves to buy energy.

-

This created permanent demand for the dollar, allowing the U.S. to:

-

Print money without hyperinflation (since dollars were always needed).

-

Run massive deficits (other nations had to absorb dollar inflation).

-

Control global finance (via SWIFT, sanctions, and Federal Reserve policies).

-

Evidence:

-

Former French President Valéry Giscard d’Estaing called this the “exorbitant privilege” of the U.S. dollar.

-

Declassified Nixon-era memos show U.S. officials explicitly discussing how oil-dollar recycling would “maintain U.S. financial supremacy.”

2. Enforcement: Coercion, Not Free Markets

The U.S. didn’t just “convince” countries to use dollars—it punished those who resisted:

-

Iraq (2000-2003): Saddam switched oil sales to euros. The U.S. invaded, toppled him, and switched Iraq back to dollars.

-

Libya (2011): Gaddafi planned a gold-backed African dinar for oil trade. NATO bombed Libya, he was killed, and the dinar died with him.

-

Venezuela & Iran: Both tried selling oil in yuan/euros/crypto—crushed by sanctions.

Key Quote:

-

Alan Greenspan (former Fed Chair) admitted in his memoir:

“The Iraq War was largely about oil… and the dollar’s role as the reserve currency.”

3. The Ultimate Goal: Preventing Any Alternative System

-

Any country that tried to bypass the dollar was isolated, sanctioned, or attacked.

-

The U.S. pressured Europe & Asia to reject alternatives (e.g., China’s yuan oil futures).

-

Central banks were forced to hold dollars (or risk losing access to oil markets).

-

-

-

-

China’s Checkmate Moves

-

2023: Saudi Arabia accepts yuan for oil.

-

2024: Russia-Iran-China form “gold-backed oil triangle.”

-

Data: PetroYuan trades up 1,200% since 2018.

-

-

The Dollar’s Collapse Symptoms

-

Fed panic (secret SWAP lines to Europe). European Central Bank: https://www.ecb.europa.eu/press/economic-bulletin/focus/2020/html/ecb.ebbox202005_01~4a2c044d31.en.html

-

U.S. states hoarding gold (Texas, Utah). Statista Graph by June 2019: https://www.statista.com/chart/19123/stockpiling-gold/

-

-

What’s Next?

-

BRICS’ “Project Gold Pay” (2025 digital currency). https://kinesis.money/blog/gold/brics-gold-currency-global-economy/

Image 7: BRICS countries and other nations are looking to reduce their dependence on the US Dollar -

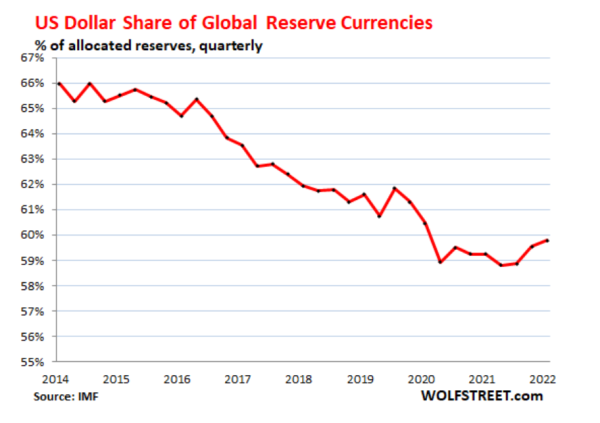

Prediction: Dollar’s reserve share <40% by 2030. Taken from Wolfstreethttps://wolfstreet.com/2023/01/01/status-of-us-dollar-as-global-reserve-currency-usd-exchange-rates-hit-foreign-exchange-reserves/

Image 8: US reserve shrinking Call to Arms:

“Dump dollar assets. Buy tangible goods. The financial war is here.”

-

More sources:

– PetroYuan oil trades (2018 vs. 2024) https://apjjf.org/2018/22/mathews

– China’s oil partners (Saudi, Russia, Iran, Venezuela) https://www.energypolicy.columbia.edu/publications/chinas-oil-demand-imports-and-supply-security/