While the festive lights of the West twinkle, a different, harsher reality darkens the holiday season for millions. This is not a temporary downturn but a deep structural crisis marked by stubborn inflation, soaring household debt, and stagnating growth. From the UK to Germany, the data reveals a “Cold Christmas” where covering basic expenses is a struggle, food bank reliance is surging, and economic pressures are reshaping the social contract.

The British Case: A Microcosm of Crisis

The United Kingdom exemplifies the continent-wide distress:

-

Debt-Fueled Holidays: Over 14 million adults struggled to cover Christmas costs, with many resorting to high-interest credit cards. Net household borrowing continues to climb. (https://www.stepchange.org/media-centre/press-releases/christmas-polling.aspx)

-

Hunger at Christmas: Charities warn an emergency food parcel will be needed every 10 seconds this winter. Last winter, over 740,000 parcels were distributed—more than 266,000 for children. ( https://www.trussell.org.uk/news-and-research/news/food-banks-brace-for-winter-surge)

-

Stagnant & Broken: Inflation remains high, unemployment has hit a 4-year peak (5.1%), and GDP shrank in late 2025. Meanwhile, the cost to fix crumbling roads is estimated at £17 billion, symbolizing a decaying foundation.(https://www.theguardian.com/business/2025/dec/16/uk-unemployment-rise-high-budget-october-ons)

A Continental Disease: Poverty Across the EU

This crisis is not confined to Britain. Across the European Union:

-

21% of the population (nearly 95 million people) are at risk of poverty or social exclusion.

-

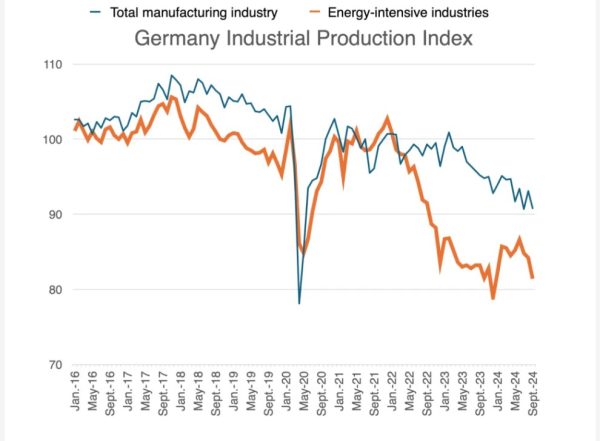

Germany, the traditional economic engine, has a poverty rate (21.1%) higher than the EU average.

-

France has seen its poverty rate climb to 21%, nearing its highest level since the 1990s.

The combination of persistent inflation, zero growth, and mounting personal debt is turning winter into a season of hardship for a significant part of the continent’s citizens.

Root Causes: Why the West is in This Hole

The current misery has deep, interlinked roots:

-

The Inflation Hangover: Post-pandemic price spikes, though slowing, have permanently raised the cost of living. Wages have not kept pace.

-

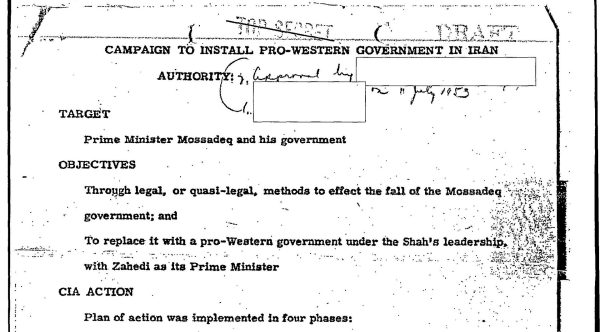

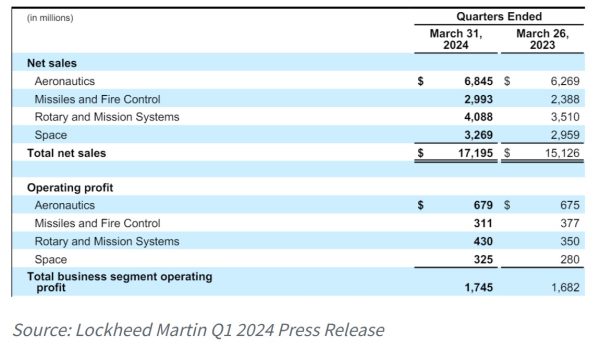

Source: https://www.statista.com/chart/33514/military-hardware-allocated-to-ukraine/?srsltid=AfmBOopfiCRKc-CRgNVn136stAWG7X3JF5xeitA-wn9Iw7NdLfJUEO71 The Cost of Foreign Wars: Hundreds of billions spent on the war in Ukraine, and continued military aid to Israel, have ballooned deficits, diverting funds from social services and forcing increased borrowing.

-

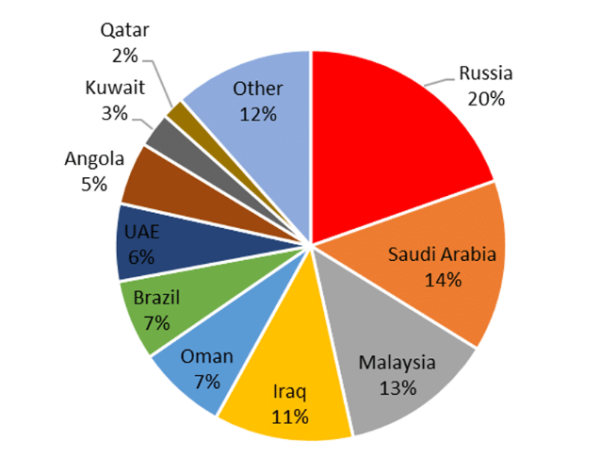

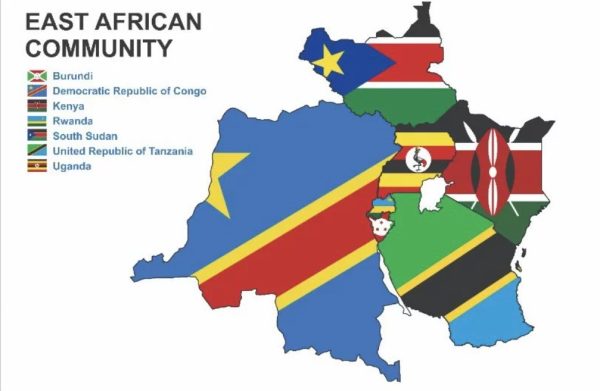

Geopolitical Shockwaves: The wars have disrupted energy markets and critical trade routes (like the Red Sea), raising costs for fuel, transport, and goods—inflation that is passed directly to consumers.

Rising insurance costs, inflation surge and containership detours Source: https://newsus.cgtn.com/news/2024-01-17/Web-Headline-Red-Sea-crisis-Rising-insurance-costs-inflation-surge-and-containership-detours-1qqvYAySjOE/p.html -

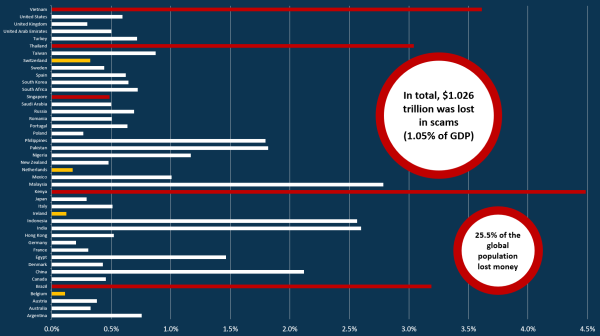

Failed Tariff Policies: Trump’s trade wars have increased import costs, disrupted supply chains, and created business uncertainty, stifling investment and hiring.

Concern Over Tariff Increases On Chinese Imports Source: https://www.cleanlink.com/news/article/Concern-Over-Tariff-Increases-On-Chinese-Imports–23900 -

Chronic Neglect: Crumbling infrastructure, from UK roads to rail networks, represents decades of underinvestment, now imposing massive costs and inefficiencies on the economy.

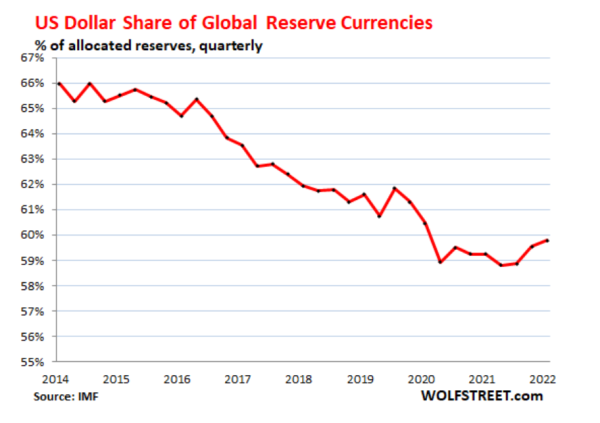

A Structural Crisis, Not a Seasonal Slump

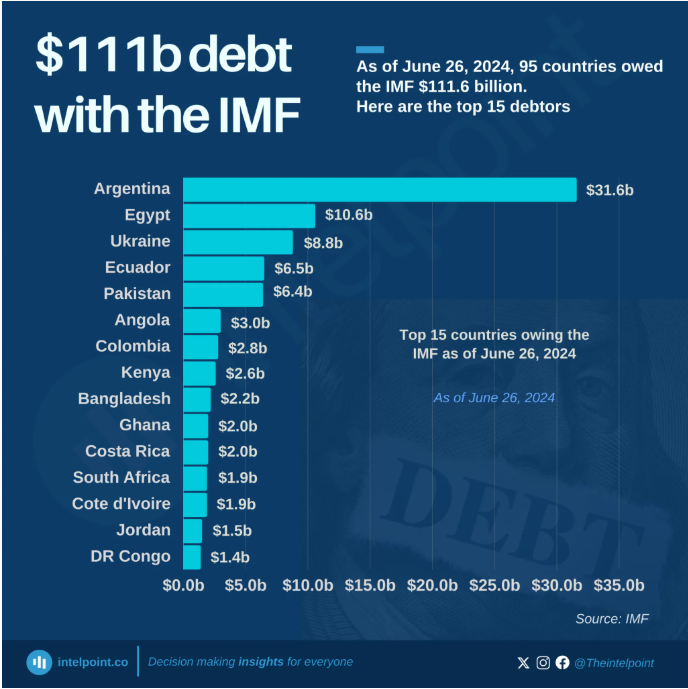

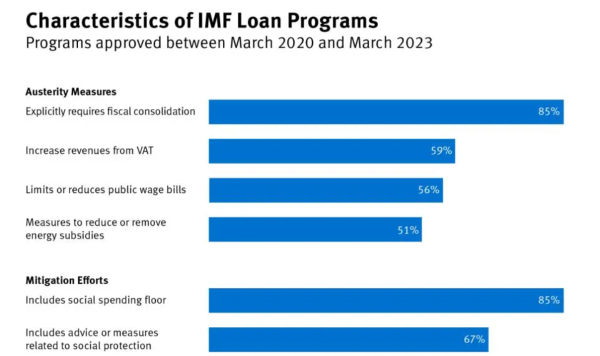

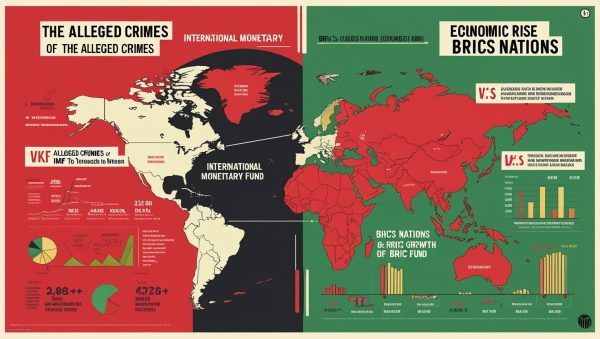

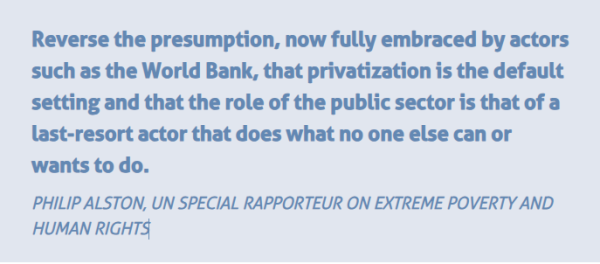

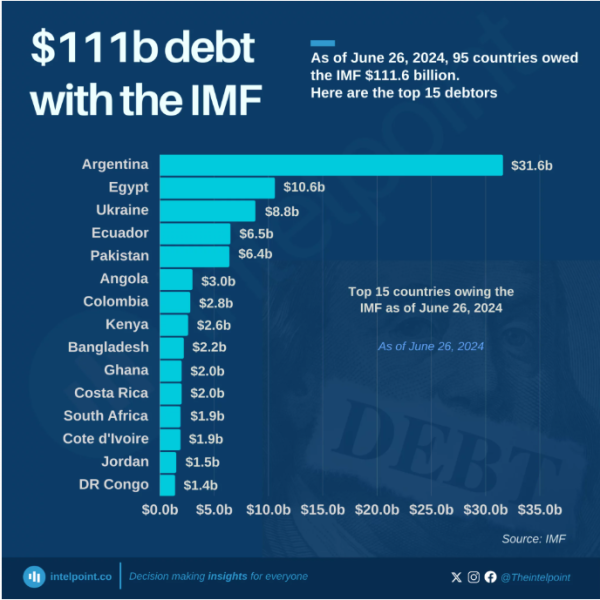

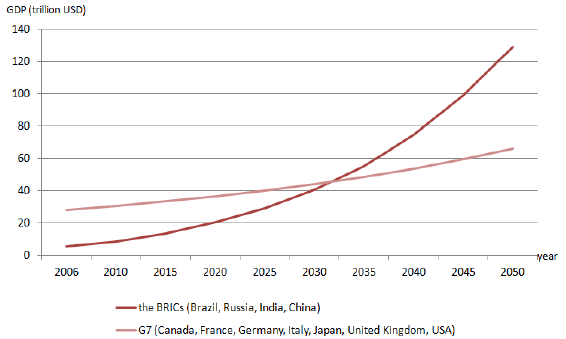

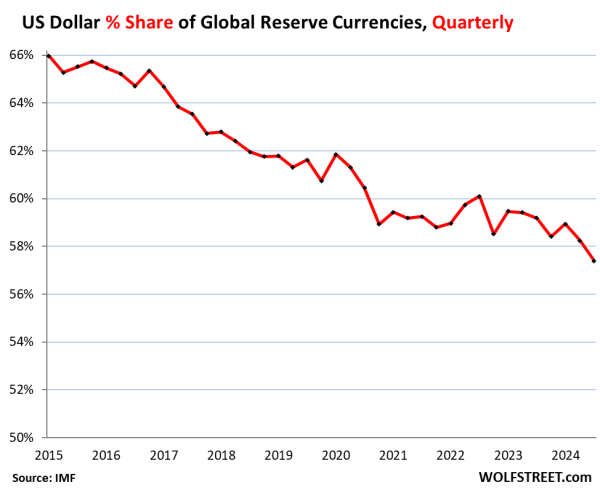

The data points to a grim truth: this is not a short-term recession but a structural and long-term crisis. The IMF now calls for “deep cuts” to Europe’s social model to fund military spending and bank bailouts, while predicting meager growth.

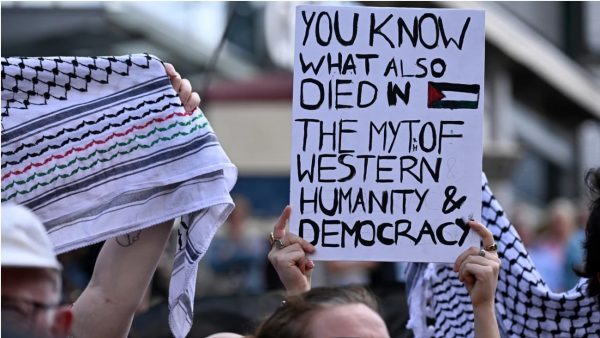

The social consequences—vanishing purchasing power, exploding household debt, and reliance on charity—reveal a deep fissure between political rhetoric and daily reality. For millions, Christmas 2025 is not a celebration of abundance but a stark reminder of a failing system. The “Cold Christmas” is more than a seasonal metaphor; it is the forecast for the West’s economic future unless these foundational flaws are addressed. The celebration has ended, and the bill has come due.