Introduction

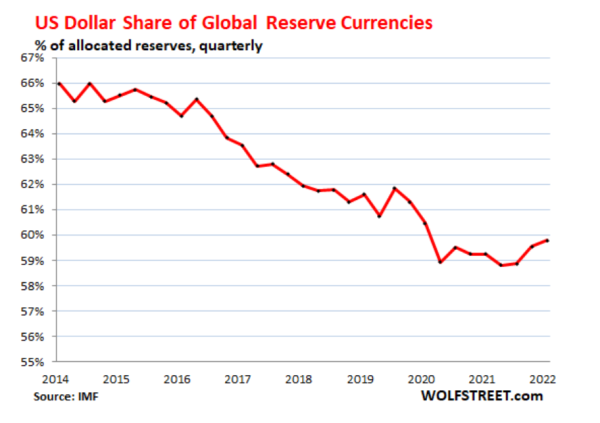

The US Federal Reserve just announced plans for a digital dollar—a move they claim will “modernize finance.” But buried in the fine print: Total control over every transaction on Earth. Meanwhile, China and BRICS race to launch their own digital currencies to break Western dominance. This isn’t about convenience—it’s the final battle for financial sovereignty.

1. The Digital Dollar: Financial Surveillance on Steroids

What It Is:

-

A government-issued Central Bank Digital Currency (CBDC)

Image 1: IMF provides central bank blueprint for CBDC decisions -

Every dollar tracked in real-time (no cash, no privacy)

Image 2: Cryptocurrencies spark concerns about privacy and freedom. Additionally, their rollout might pose challenges for fintech companies, big banks, the crypto industry, and – if you’re investing in any of them – your portfolio. -

Programmable: Authorities can freeze funds or impose spending limits

Image 3: Governments can freeze accounts or impose sanctions Hidden Agenda:

-

Crush sanction evaders (Iran, Russia, Venezuela) by killing “black market” dollar trades.

-

Eliminate cash—forcing all transactions into traceable digital wallets.

-

Social control: Imagine your money disabled for protesting, buying “unapproved” goods, or donating to Palestine.

Shocking Fact: The Fed’s 2022 pilot program already tested automatic tax deductions from digital wallets.

-

According to the Bank of International Settlements, 93% of the world’s central banks have launched studies of digital currencies, and 15 CBDCs are expected to circulate publicly by 2030 (you can track their progress with this online tool). Some say it’s a sign that central banks are essentially all fighting for control of their monetary systems, with the crypto market becoming more of a challenge to fiat currencies and threatening the tools central bankers rely on to control their economies. (https://www.aberdeenplc.com)

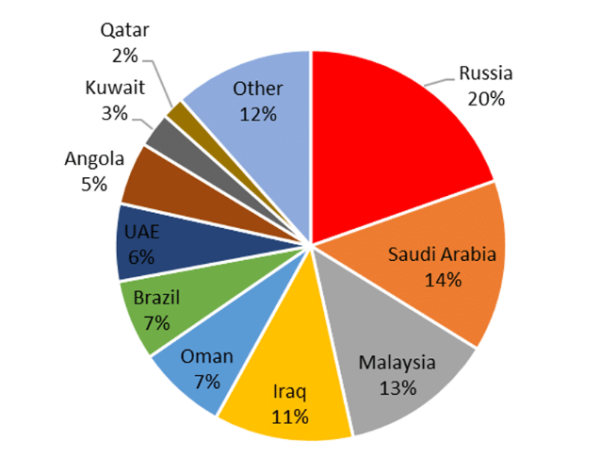

2. BRICS Strikes Back: The Digital Gold Standard

China’s Digital Yuan (DCEP):

-

Already used in $250B+ transactions (2024 data)

-

Bypasses SWIFT—trades oil with Iran/Saudi in yuan

-

No sanctions risk: US can’t freeze what it doesn’t control

BRICS’ Gold-Backed Currency:

-

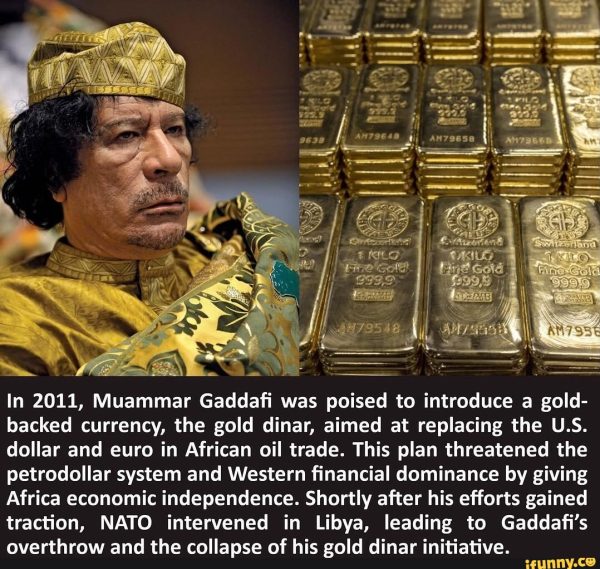

Coming 2025–2026 (leaked Kremlin docs)

-

1:1 gold reserves—direct challenge to fiat dollar monopoly

-

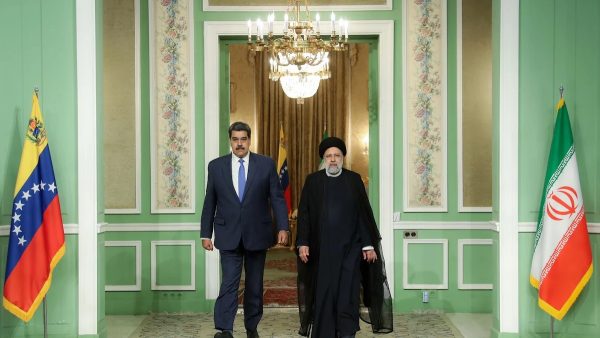

Venezuela/Iran and others under US’ sanctions, will use it to escape US embargoes

Killer Quote:

“The digital yuan isn’t about technology—it’s about deleting America’s veto on global trade.”

—Former PBOC Governor

3. The EU’s Digital Euro: A Wolf in Sheep’s Clothing

-

“Climate” controls: Transactions capped for carbon footprints

-

Mandatory expiration dates (stimulus money usable only for 3 months)

-

Tied to social credit: French trials blocked purchases of “unhealthy” food

Irony Alert: The same EU that condemns China’s social credit system is building its own.

4. The Nightmare Scenario: A Digitally Colonized World

For the Global South:

-

No more dollar black markets = No way to bypass sanctions

-

IMF loans auto-deducted from national CBDC reserves

-

US/EU could remotely strangle economies (e.g., cut Nigeria’s access to digital dollars)

For Citizens:

-

Your savings programmable (e.g., “Use by 2025 or lose it”)

-

Political dissent = Financial death (frozen wallets)

-

Total consumption surveillance (buy Bitcoin? Flagged.) Quote Google AI:

Potential for Surveillance:-

Detailed Transaction Data:CBDCs, unlike physical cash, can record every transaction, including the amount, time, and location.

-

Centralized Data:A CBDC system could centralize this data with the central bank or other financial institutions, creating a massive database of spending habits.

-

Government Access:

Concerns exist that governments or other entities could access this data for surveillance purposes, potentially tracking individuals’ movements, consumption patterns, and political affiliations.

Privacy Concerns:-

Data Breaches:

The concentration of sensitive data in a central location raises the risk of data breaches and cyberattacks, potentially exposing individuals’ financial information.

-

Misuse of Data:

Even without breaches, there are concerns about how the data might be used, such as for targeted advertising, credit scoring, or even political profiling.

-

Erosion of Trust:Public distrust in the system could erode if people fear their spending habits are being monitored.

5. The Escape Routes: Who Will Win?

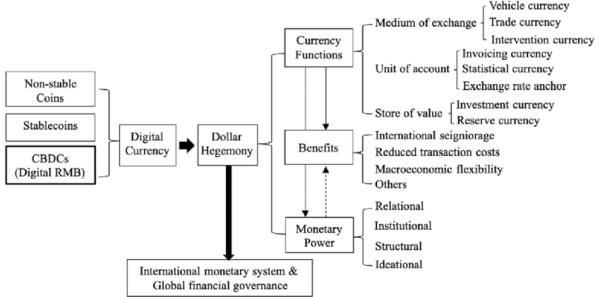

Option 1: Digital Dollar Hegemony

Image 5: Assessing Digital Challenges to Currency Hegemony with the case of Digital RMB and Dollar Dominance -

A financial NATO where the US/EU dictate all trade

-

Sanctions 2.0: Any country can be economically nuked in seconds

Option 2: BRICS Gold-Backed System

Image 6: For years Brics countries amassing gold, signaling a delibrate move away from the US Dollar’s golbal dominance -

Return to hard assets (gold, commodities)

-

Africa/Latin America finally escape IMF debt traps

-

The end of exorbitant dollar privilege

Wild Card: Bitcoin

-

Decentralized, uncensorable—but can it scale before CBDCs dominate?

Image 7: operates independently of a central bank Conclusion: The Financial Iron Curtain Descends

The digital dollar isn’t progress—it’s economic warfare. BRICS knows this and is fighting back with gold. The question isn’t if the old system dies, but whether we’ll be slaves to a digital Fed or citizens of a multipolar world.

Time to choose sides.

-