They can’t repay it. They won’t default. Their solution? Lure the world into a digital casino, swap the debt for blockchain tokens, and pull the plug. Your savings will be the casualty.

1. The Unsolvable Problem: A $35 Trillion Debt

The United States is not just in debt; it is functionally bankrupt. With a national debt exceeding $35 trillion and growing by trillions each year, repayment is a mathematical impossibility. Traditional solutions—austerity or hyperinflation—would collapse the global economy and end American hegemony overnight.

So, what’s the exit strategy?

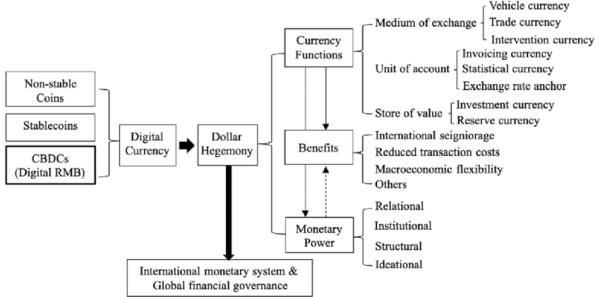

2. The Digital “Solution”: Enter Cryptocurrency

For years, crypto has been marketed as the future of money: decentralized, borderless, and free from government control. This is the bait.

The real plan is far more cynical. The US financial establishment isn’t trying to escape crypto—it’s preparing to co-opt it as a dumping ground for its unpayable debts.

Here’s how the scheme works:

-

Legitimize Crypto: Encourage massive institutional investment (ETFs, Wall Street backing) to create the illusion of stability.

Image 3: In March, President Trump said that he hoped to sign stablecoin legislation by August. Congress has responded accordingly: In the past month, both the House and Senate have advanced stablecoin bills out of committee. -

Merge with Sovereign Debt: Issue US Treasury bonds or a “Digital Dollar” directly on blockchain networks, effectively converting national debt into crypto-backed assets.

Image 4: First central banks ignored cryptocurrencies, then they mocked them, next they fought them and now they are building their own. -

The Global Dump: Once the world’s savings are tied to this new system, the Fed can “devalue” or “reset” the digital ledger—erasing the $35 trillion debt with a keystroke.

Your Bitcoin portfolio wouldn’t crash; it would be zeroed out by design.

3. The Precedent: They’ve Done This Before

This is not a new trick—it’s a digital update of an old one.

-

1944: Bretton Woods – The US made the dollar the world’s reserve currency, forcing other nations to hold US debt.

Image 5: Under the Bretton Woods system, gold was the basis for the U.S. dollar, and other currencies were pegged to the U.S. dollar’s value. -

1971: Nixon Shock – The US unilaterally ended dollar convertibility to gold, effectively defaulting on its obligations without admitting it.

Image 6: Most notably, the policies eventually led to the collapse of the Bretton Woods system of fixed exchange rates that took effect after World War II.

Key Takeaways

The Nixon Shock relates to an economic policy shift undertaken by President Nixon to prioritize jobs growth, lower inflation, and exchange rate stability.

It effectively led to the end of the convertibility of U.S. dollars into gold.

The Nixon Shock was the catalyst for the stagflation of the 1970s as the U.S. dollar devalued.

Thanks in large part to the Nixon Shock, central banks have more control over their nations’ money and the management of variables such as interest rates, overall money supply, and velocity.

Long after the Nixon Shock, economists are still debating the merits of this policy shift and its eventual ramifications. -

2008: The Bailouts – Banks offloaded toxic assets onto the public balance sheet. You paid for it.

Image 7: In 2008, more than 70% of subprime and other low-quality mortgages were on the books of the federal government, primarily the “Government Sponsored Enterprises” Fannie Mae and Freddie Mac. The GSEs bought these riskier mortgages to meet the politically-motivated “affordable housing goals” that Congress assigned to them. As Peter Wallison, who served as on the Financial Crisis Inquiry Commission, said, when these mortgages defaulted, they drove down housing prices, weakened most large financial institutions and caused the financial crisis.

The ”Crypto Reset” is simply the next phase: offloading the toxic national debt onto the global public via the blockchain.

4. The Warning Signs Are Already Here

-

Wall Street’s Sudden Love for Crypto: BlackRock and Fidelity didn’t become libertarian pioneers. They see a new asset class to financialize and control.

Image 9: Wall Street: From Hostility to Embrace -

Central Bank Digital Currencies (CBDCs): The ultimate tool for a controlled reset. A digital dollar gives the government full visibility and control over every transaction.

Image 10: Unlike cryptocurrencies, which are decentralized and volatile, CBDCs aim to provide stability and are government-backed. -

Regulatory “Clarity”: Governments aren’t regulating crypto to protect you; they’re regulating it to absorb it.

https://www.purduegloballawschool.edu/blog/news/crypto-regulation

What Is Crypto Regulation?

When we talk about cryptocurrency regulation, we’re referring to the creation of frameworks to oversee or supervise different aspects of crypto. Such frameworks include rules to address how crypto is created, purchased, sold, traded, taxed, and how it integrates with the financial systems already in existence in the U.S. and worldwide. These types of frameworks already exist for traditional assets, which are highly regulated in the U.S. by federal agencies, including the Securities and Exchange Commission (SEC), Federal Reserve Board (FRB), and Federal Deposit Insurance Corporation (FDIC).

Why Regulate Crypto?

Like traditional asset regulation, crypto regulation benefits the market in several ways, including:

- Increasing investor confidence

- Protecting investors from scams, fraud, and market manipulation

- Ensuring investors get accurate and necessary information about crypto

- Encouraging innovation

- Making crypto accessible to more people

- Preventing financial crimes and fraud

- Ensuring tax compliance

- Providing stability in financial markets

Who Regulates Crypto?

Crypto is now regulated at a number of levels and by several agencies, both in the U.S. and internationally.

U.S. Regulations — Federal

In the U.S., there has thus far been a lack of consistent cryptocurrency regulation. Several U.S. regulatory bodies — including the Internal Revenue Service (IRS), SEC, the Commodity Futures Trading Commission (CFTC), the Department of Justice, the Federal Reserve, the Department of the Treasury, the Bureau of Industry and Security, and the Financial Crimes Enforcement Network — have all weighed in on how crypto should be classified or handled.

In addition, the SEC and CFTC have been vying for enforcement authority over crypto.

- The SEC sees crypto assets as securities, similar to stocks.

- The CFTC sees crypto assets as commodities, similar to gold or oil.

5. Who Really Wins?

-

The US Government: Its debt disappears.

-

Wall Street: Skims fees during the boom and is first to exit before the bust.

-

The Global Elite: Preserve their wealth in hard assets (gold, land, commodities) while digital savings evaporate.

Who loses?

Anyone holding significant wealth in digital assets when the music stops.

Conclusion: Don’t Be the Bagholder

Crypto was sold as a revolution against the system. In reality, it may become the system’s most sophisticated exit strategy.

The greatest trick the US ever pulled was convincing the world that its debt was an asset. The second greatest trick will be convincing you that crypto is the future, when it’s really just the new landfill for their financial trash.

The reset is coming. The question is, will your wealth survive it?