China’s Massive US Treasury Dump: Is the Dollar’s Dominance Coming to an End?

Introduction

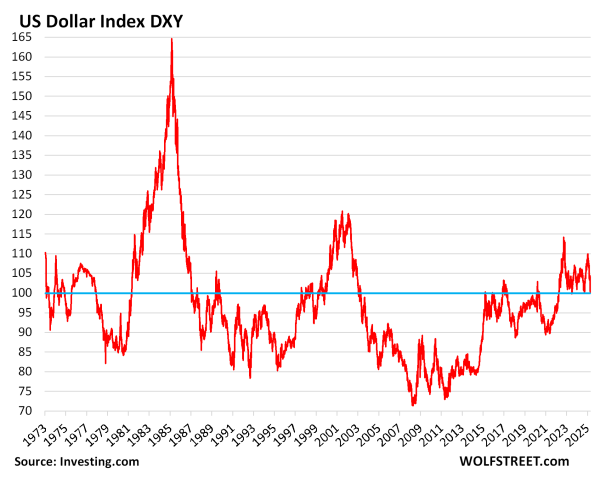

For decades, the US dollar has reigned supreme as the world’s reserve currency, backed by the “full faith and credit” of the United States. The US Treasury market—long considered the safest investment—has been the backbone of global finance. But what happens when the biggest foreign holder of US debt, China, starts unloading its holdings at an unprecedented pace?

Recent reports suggest China is selling $3 billion worth of US Treasuries per week:

—a move that could trigger a financial earthquake. If this trend continues, the consequences for the US economy could be catastrophic.

Why Is China Dumping US Debt?

China has been gradually reducing its Treasury holdings for years, but the pace has dramatically accelerated. Here’s why:

- De-Dollarization Efforts

- China, Russia, and BRICS nations are actively moving away from the dollar in trade.

Image 1: BRICS countries and other nations are looking to reduce their dependence on the US Dollar - Beijing is stockpiling gold(over 2,200 tons) and promoting the yuan in global transactions.

- The goal? Break US financial hegemony and reduce vulnerability to sanctions (like those on Russia). Empowerment Versus Entrapment

- Economic Warfare

- The US has weaponized the dollar through SWIFT bans, sanctions, and asset freezes.

- China sees holding massive dollar reserves as a strategic risk—especially if US-China tensions escalate.

Image 2: Increasingly intensifying U.S. economic sanctions targeting Russia’s financial system have deepened concerns in China over its extensive dollar asset holdings and the Chinese financial system’s reliance on dollars. - Preparing for a Financial Crisis

- If the US faces a debt crisis, hyperinflation, or a bond market crash, China wants to minimize exposure.

Image 3: De-dollarization is an effort by a growing number of countries to reduce the role of the U.S. dollar in international trade. Countries like Russia, India, China, Brazil and Malaysia, among others, are seeking to set up trade channels using currencies other than the almighty dollar. With President Donald Trump’s international trade war ramping aggressively, is the reserve status of the U.S. dollar going to be the next domino to fall? - Selling Treasuries now could be a hedge against a future dollar collapse.

The Domino Effect: What Happens If China Keeps Selling?

- Rising US Interest Rates

- If China (and others) dump Treasuries, demand falls, forcing the US to offer higher yields to attract buyers.

- This means higher borrowing costs for the US government—worsening the $34 trillion debt crisis.

- Inflation & Dollar Devaluation https://study.com/academy/lesson/video/the-impact-of-currency-appreciation-depreciation-on-inflation.html

- The Federal Reserve may be forced to print more moneyto buy its own debt (quantitative easing).

- More dollars chasing fewer goods = runaway inflation, destroying purchasing power.

- Loss of Global Confidence in the Dollar

- If major economies abandon the dollar, its reserve currency status

- Countries may demand payment in gold, yuan, or cryptocurrencies

- A Potential US Debt Collapse

- The US relies on foreign buyersto fund its deficits.

- If China exits, and others follow, the Treasury market could freeze up, leading to a liquidity crisis.

The US Response: Arrogance or Ignorance?

US policymakers have long assumed the world has no choice but to buy Treasuries. Their confidence rests on:

- “The dollar has no alternative”(Petrodollar system).

- “We can print unlimited money without consequences.”

But history shows all empires fall when their currency fails—Rome, Britain, and soon, perhaps, America.

China’s Treasury dump is a warning shot. If this accelerates, the US could face:

✔ A bond market crash

✔ A dollar crisis

✔ A sovereign debt default

Conclusion: Is the Dollar’s Endgame Near?

China’s $3 billion/week Treasury sell-off is not a coincidence—it’s a calculated move in a larger financial war. If this trend continues, the US will face a day of reckoning: either hyperinflation, default, or a brutal austerity crisis.

The era of “exorbitant privilege” (where the US borrows endlessly without consequences) may soon be over.

The question is no longer if the dollar collapses—but when.